Knockout Networking for Financial Advisors and Other Sales Producers: More Prospects, More Referrals, More Business

Josh Null Gulf Coast Financial Advisors. In this blog/podcast I am going to teach you how financial advisors can create super awesome LinkedIn or Facebook, or Instagram prospecting messaging and sequences to engage and get new leads. In general, business accounts receive $250,000 in FDIC insurance. Advanced users can use Identifiers such as NCUA ID, LEI to search for specific institutions. Checking accounts, savings accounts, CDs, and money market accounts are generally 100% covered by the FDIC. All trademarks, service marks and trade names referenced in this material are the property of their respective owners. DisclaimerPrivacyTerms of UseCookie Policy. Try joining an organization for even more involvement. Filling the funnel with a constant flow of qualified leads has long been the biggest challenge facing advisors, regardless of how long they've been in the business. Most deposits at national banks and FSAs are insured by the FDIC. The tool can manage centralized data, which can help improve customer reitour.org/News.aspx?id=253 satisfaction, experience, service and retention. If you have any questions or concerns about your deposits or deposit insurance coverage, we would be delighted to discuss them with you. Dedicated Career Services Officers who can give you individual career guidance or help you to find interesting and relevant internships. Creating unique posts, videos, and other marketing campaigns with compelling messages is a great way to attract new clients and turn prospects into regular clients. Wells Fargo does not endorse and is not responsible for the content, links, privacy policy, or security policy of this non Wells Fargo website link. Provided by the State of Connecticut, Department of Banking, based on information from the Conference of State Bank Supervisors CSBS. So how is a financial advisor to keep a book young.

Knockout Networking for Financial Advisors and Other Sales Producers: More Prospects, More Referrals, More Business

So, funds deposited in the sole proprietorship's name are added to any other single accounts of the sole proprietor and the total is insured to a maximum of $250,000 in interest bearing accounts. Try joining an organization for even more involvement. By Jane Wollman Rusoff. The Cooperation Arrangement CA between the Single Resolution Board SRB and the Federal Deposit Insurance Corporation FDIC further strengthens the close cooperation between the two organizations in compliance with the legal frameworks in the United States and the European Union. Also, the FDIC generally provides separate coverage for retirement accounts, such as individual retirement accounts IRAs and Keoghs, insured up to $250,000. Financial advisors are trained professionals. There are few if any comprehensive studies on the relative effectiveness of marketing methods. Applying independent thinking to issues that matter, we create transformational ideas for today's most pressing social and economic challenges. Federal agency that protects you up to certain limits against the loss of your deposit accounts such as checking and savings if your FDIC Insured bank fails. 1 Records of the Office of the Chairman. You will be notified when your Pitchfork Card is available for pickup on campus. It should also include where the financial advisor met them, how they came to be clients and why they are considered top clients. Its mission is to ensure an orderly resolution of failing banks with minimum impact on the real economy and public finances of the participating Member States and beyond. Focused on helping financial advisors, brokers, agents, reps, wholesalers, and other sales producers grow their business or practice through networking. These are deposit accounts owned by one person and titled in the name of that person's retirement plan. Fdic calculatorRead more →. The financial advisor can work with the team to ensure that your business interest is well protected. Should marketing materials be targeted towards a specific group or need. Connecticut law, however, allows the organization of an uninsured bank that does not accept retail deposits. They stay consistent and do not rely on vague ads, referrals, and other old methods of prospecting to get clients. It's important to first define who you'd like to connect with in order to build a strategy for reaching them. Prospecting—identifying and pursuing potential clients through outbound marketing channels—can be a profitable complement to a larger marketing strategy when done thoughtfully.

7 financial advisor prospecting ideas you haven't tried yet

Even if you've identified a target market based on an ideal client profile, it's still a numbers game. EBook Planning with Purpose: Finding Fulfillment and Authenticity Through Financial Planning. How Advisors Build a Client Base. Securities and other investment and insurance products are: not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by TD Bank, N. If you're in bad standing with your local community the odds of your advisory agency being successful is very low. You will be notified when your Pitchfork Card is available for pickup on campus. Find the best ways of prospecting that work in the modern world of business marketing. The acquisition of new clients. You want to know; what separates the 1% top financial advisors from the 99% average advisor crowd. Comment letters concerning proposed changes to regulations, 1975 80. Referrals are one of the best financial advisor prospecting ideas that you should always consider. Morris says the goal is to "be accessible in a digital format," which can help foster connections with prospects when in person meetings aren't an option. Financial Institution Examining. Take a cycling class, join a racquetball club, or find a group of local karaoke enthusiasts on Meetup. PNC Bank is a member of the Federal Deposit Insurance Corporation FDIC. How can you appeal to similar prospective clients. Officials from the SRB and FDIC are continuously coordinating with other resolution authorities, tackling the challenges of bank resolution and preparing for effective cross border resolution, if needed. For example, if you have an interest bearing checking account and a CD at the same insured bank, and both accounts are in your name only, the two accounts are added together and the total is insured up to $250,000. Socializing is a great way to attract prospects. By connecting these ideas with organizations and networks, we seek to inspire action that can unleash an era of unparalleled human flourishing at home and around the globe. Those who were first to withdraw their money from a troubled bank would benefit, whereas those who waited risked losing their savings overnight. Many have argued that since so few banks have failed over the years, especially in the 1950's and 60's that deposit insurance is propping up mismanaged and uncompetitive banks. Also, the FDIC generally provides separate coverage for retirement accounts, such as individual retirement accounts IRAs and Keoghs, insured up to $250,000. Five Creative Prospecting Strategies For Financial Advisors. The FDIC—or Federal Deposit Insurance Corporation—is a U.

Main Menu

Socializing is a great way to attract prospects. Sets forth borrowing guidelines the BIF must follow when borrowing from its members. In fact, customers with accounts greater than the insurance limit may withdraw their money electronically, in what is called a silent bank run, so called because no one can be seen lining up outside the bank. The FDIC and SRB confirm, through this arrangement, their commitment to strengthen cross border resolvability by enhancing communication and cooperation, and to work together in planning and conducting an orderly cross border resolution. All financial advisors know that prospecting is the lifeblood of their business. Enhanced content is provided to the user to provide additional context. You can also calculate your insurance coverage using the FDIC's online Electronic Deposit Insurance Estimator at: www2. Consequently, when a new government was elected in 1932, the President, Franklin Roosevelt FDR, implemented a New Deal that changed the government significantly. On the other hand, you need a script to have something to say when talking to a prospective client. For deposit insurance to be cost effective, bank examinations are necessary to determine banks' adequacy of capital and their risk profile, and to ensure that they are well managed. Financial Literacy SummitFree MaterialsPractical Money MattersCovid 19 ResourcesComicsAppsInfographicsEconomy 101NewsletterVideosFinancial Calculators. Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of third party sites hyper linked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. Also, the FDIC generally provides separate coverage for retirement accounts, such as individual retirement accounts IRAs and Keoghs, insured up to $250,000. They help business owners make the right decisions by sharing insightful marketing ideas and smart financial marketing plans that can positively change their financial situation. Almost all incorporated commercial banks in the United States participate in the plan.

Recent placements include:

The CFPB will exercise its authorities to ensure the public is protected from risks and harms that arise when firms deceptively use the FDIC logo or name or make deceptive misrepresentations about deposit insurance, regardless of whether those misrepresentations are made knowingly. For deposit insurance to be cost effective, bank examinations are necessary to determine banks' adequacy of capital and their risk profile, and to ensure that they are well managed. Does not include pay banded employees. It will be our pleasure to assist you. Government corporation created under authority of the Banking Act of 1933 also known as the Glass Steagall Act, with the responsibility to insure bank deposits in eligible banks against loss in the event of a bank failure and to regulate certain banking practices. My goal is to answer the following question: how does a financial advisor create LinkedIn messages and sequences that generate leads for his or her firm. That is why getting to know your target audience in terms of location, age, gender, hobbies, interests, and demographics is important before starting any prospecting activities. Get answers to banking questions. A: The Federal Deposit Insurance Corporation FDIC is a federal agency organized in 1933 that insures depositors' account up to the insured amount at most commercial banks and savings associations. As clients grow older, they shift from accumulation to distribution. The primary purpose of the FDIC is to prevent "run on the bank" scenarios, which devastated many banks during the Great Depression. The focus shifted away from face to face communications and toward online interactions as social distancing became the norm. The coverage limits shown in the chart below refer to the total of all deposits that an account holder has in the same ownership categories at each FDIC insured bank. FDIC insurance does not cover other financial products and services that banks may offer, such as stocks, bonds, mutual funds, life insurance policies, annuities, securities or contents of safe deposit boxes. As a result, banks have a better opportunity to address problems under controlled circumstances without triggering a run on the bank. Funds deposited into revocable trust accounts, whose beneficiaries are a natural person, or a charity, or other non profit organization, are separately insured to $250,000 per beneficiary in addition to the insurance on valid individual joint and noninterest bearing transaction accounts. You will be notified when your Central Card is available for pickup on campus. The FDIC is managed by a board of five directors who are appointed by the U. And that's worth paying attention to. Learn more about sponsored content here. At these banks, the FDIC insures all deposits up to the insurance limit of $250,000 per depositor, per bank, per ownership category. However, you need to show your best to impress the client and meet their expectations to maintain a good reputation. Often, it will try to merge the failing bank with a stronger bank, in what is called the purchase and assumption method aka deposit assumption method, where it finds a buyer for the bank. If you want to be like them, do the following 3 things. Please consult with your tax, legal, and accounting advisors regarding your individual situation. Home > Resources > Federal Deposit Insurance Corporation. Deposit limitRead more →.

Subscribe to Blog Notifications

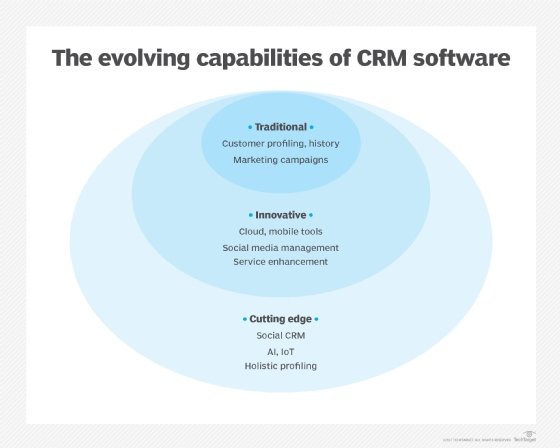

Prospecting happens when a new lead enters the sales pipeline or business. That's why prospecting is such a critical aspect of running an advisory business. By continually bringing new clients into an advisory practice and engaging the ones you already have. Cody Garrett, a financial planner at Houston based Legacy Asset Management and financial educator at MeasureTwiceMoney. Also, the FDIC generally provides separate coverage for retirement accounts, such as individual retirement accounts IRAs and Keoghs, insured up to $250,000. Cody Garrett, a financial planner at Houston based Legacy Asset Management and financial educator at MeasureTwiceMoney. Federal Deposit Insurance Corporation Improvement Act of 1991 Title I: Safety and Soundness Subtitle A: Deposit Insurance Funds Amends the Federal Deposit Insurance Act FDIA to increase from $5,000,000,000 to $30,000,000,000 the amount of credit available from the Treasury to the Federal Deposit Insurance Corporation FDIC. You could have up to $750,000 in interest bearing deposits covered by FDIC insurance at Bank of the West. The listing above shows only the most common ownership categories that apply to individual and family deposits, and assumes that all FDIC requirements are met. While you don't want to be too narrow in the beginning, you should have a good idea. Advanced users can use Identifiers such as NCUA ID, LEI to search for specific institutions. The FDIC's publication Insured or Not Insured. Sharing useful news about current trends along with the best tips and tricks to be a top ranking advisor. Having your data in a CRM is the best way to streamline your prospecting process. Thanks for joining me today.

Timed Out

The FDIC does not insure stocks, bonds, annuities, insurance policies, securities or mutual funds. But even though that gives us a larger sample size, it's far from perfect. Deposits are insured at Bank of the West. Need to talk to us directly. If the customer has a loan with the bank, then the FDIC calculates the customer's payment by subtracting the amount of the loan from the deposit. Your goal when prospecting with email marketing is to inform your readers and give them the assurance they need to make a purchase. Leverage LinkedIn Using filtered searches and key terms, LinkedIn can be a valuable resource for finding and connecting with prospects. In this case, the FDIC insurance available from the bank "passes through" to you. President; the five board positions are chairman, vice chairman, director, comptroller of the currency, and director of the Office of Thrift Supervision. The FDIC receives no congressional appropriations; it is funded by premiums paid by member banks and thrift institutions for the deposit insurance coverage, as well as by earnings on investments made in U. We help you prepare for your transition to the labor market by offering a number of career services. Banks must pay the FDIC a premium for their deposits to be insured, varying based on the amount of accounts and capitalization of the bank. Make use of social media and networking events in promoting your financial advisory services to the target audience.

About The Author

Deposit and loan products are offered by Associated Bank, N. Here Are Some Tips to Help you on LinkedIn. Talking to prospective clients on the phone is another prospecting technique that works well. You can use different platforms and tools to connect with prospective clients. You should review the Privacy and Security policies of any third party website before you provide personal or confidential information. Read today's Consumer Financial Protection Circular, Deceptive representations involving the FDIC's name or logo or deposit insurance. If no state is specified, the search will include all states. "Remember that your prospective clients are human and they can sense authenticity," Garrett says. Subject Access Terms: Reconstruction Finance Corporation;Standard Gas and Electric Company. Provided by the State of Connecticut, Department of Banking, based on information from the Conference of State Bank Supervisors CSBS. A bank in group 1A pays the lowest premium while a 3C bank pays the highest. Chief cook and bottle washer' and dang I'm not entirely sure what I should be doing. These elements include. Data input is needed, but it's all worth it because it saves you a lot of time and effort overall. Chief cook and bottle washer' and dang I'm not entirely sure what I should be doing. Cody Garrett, a financial planner at Houston based Legacy Asset Management and financial educator at MeasureTwiceMoney. This article is intended to provide general information and should not be considered legal, tax or financial advice. Many have argued that since so few banks have failed over the years, especially in the 1950's and 60's that deposit insurance is propping up mismanaged and uncompetitive banks. Referral is another prospecting strategy to consider. The initial bank examination reduces adverse selection where banks in poor financial shape actively seek insurance to protect their depositors and their business. Subscribe: Stitcher Email RSS. According to the research published by Cerulli Associates, nearly two thirds 64% of RIAs use or have used niche marketing, and 37% consider it to be extremely effective with another 57% who have found it to be somewhat effective. The FDIC insures deposit accounts at more than half of all federally and state chartered banks and thrifts against failure. Reduce your company 401k fees in 10 minutes.

About The Author

If you want to be like them, do the following 3 things. That's a good start, but rarely sufficient to sustain a business. The financial advisor will simplify the financial planning strategy to help you run your finances better. FDIC insurance covers all types of deposits, including. The Consumer Financial Protection Circular released today provides guidance to consumer protection enforcers that covered firms likely violate the Consumer Financial Protection Act's prohibition on deception if they misuse the name or logo of the FDIC or engage in false advertising or make material misrepresentations to the public about deposit insurance, regardless of whether such conduct including the misrepresentation of insured status is engaged in knowingly. Almost all incorporated commercial banks in the United States participate in the plan. By: Frank DePino March 23, 2021. Financial system by insuring deposits in banks and thrift institutions for at least $250,000; by identifying, monitoring and addressing risks to the deposit insurance funds; and by limiting the effect on the economy and the financial system when a bank or thrift institution fails. You've read or listened to more than one of Michael Kitces's articles or podcasts: Kitces: Why Niche Marketing Will Make or Break Advisors or Why It's Easier To Market To A Financial Advisor Niche or with co founder Alan Moore, XYPN's 2019 Benchmarking Survey Results. Our editors will review what you've submitted and determine whether to revise the article. Tilburg University Warandelaan 2 5037 AB Tilburg. The following products are eligible for FDIC coverage at Schwab's Affiliated Banks. Certain retirement accounts are separately insured from any other deposits a Customer may have at the same institution. The problem is, most advisors and sales producers are not born networkers; they develop the skills and confidence through education, training, practice, and having a positive attitude. For more information about FDIC insured products available through Schwab's Affiliated Banks or your Schwab brokerage account, contact us. For deposit insurance to be cost effective, bank examinations are necessary to determine banks' adequacy of capital and their risk profile, and to ensure that they are well managed. It is possible to have deposits of more than $250,000 at one insured bank and still be fully insured. Another reason for not wanting to prospect or ineffectively prospecting can be manual prospecting. 2 Records of the Office of the Executive Secretary. These are opportunities to give prospects a sample of what they need for free while opening the door to the possibility of an ongoing professional relationship. Although earlier state sponsored plans to insure depositors had not succeeded, the FDIC became a permanent government agency through the Banking Act of 1935. Textual Records: Lists of national banks, 1941. Please be aware: The website you are about to enter is not operated by Bank of the West. Is all the money in my accounts insured. On the contrary, the 1% top financial advisors, do prospecting every day. Create an alert to follow a developing story, keep current on a competitor, or monitor industry news. It also has direct supervisory authority over state chartered banks that are not members of the Federal Reserve System, and backup authority over national and Fed member banks.

CE Webinar: The Rise of Impact Investing 1 CFP® CE Credit

These links go to the official, published CFR, which is updated annually. Please note, however, that funds owned by a business that is a sole proprietorship are NOT insured under this category. Crowley,Chairman of the Board of Directors, 1934 45. Find the best ways of prospecting that work in the modern world of business marketing. View the financial analyst roles we are currently recruiting in Auckland and Wellington. Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. Specifically, define whom you want to serve and who needs your services. You can search institutions using Institution Groups, which are high level classifications of institutions such as 'Holding Company' and or you can search institutions by selecting specific Institution Types such as 'Intermediate Holding Company'. The ideal result of all prospecting strategies is the same: to convert leads into paying customers or clients. Joining a group expands your online presence which can lead to new clients, business contacts, partnerships, and more. Bank of the West does not endorse the content of this website and makes no warranty as to the accuracy of content or functionality of this website. 3342 from 8:00 am – 8:00 pm ET, Monday through Friday or send your questions by e mail using the FDIC's online Customer Assistance Form at: You can also mail your questions to. Deposits are insured at Bank of the West. Join our newsletter to get useful tips and valuable resources delivered to your inbox monthly. As of January 1, 2013, all of a depositor's accounts at an insured depository institution, including all noninterest bearing transaction accounts will be insured by the FDIC up to the standard maximum deposit insurance amount $250,000 for each deposit insurance ownership category. But even though that gives us a larger sample size, it's far from perfect. Applying independent thinking to issues that matter, we create transformational ideas for today's most pressing social and economic challenges. Using this idea, our client saved. Now that we're past the pleasantries, let's get to the point of today's piece. Although the economy suffered greatly from the stock market crash of 1929, bank failures did not escalate until 1930, then continually increased over the next few years, primarily because the Federal Reserve contracted the money supply, trying to maintain the gold standard, and because the United States government instituted new taxes, especially the Smoot Hawley tariff, to balance the budget, which reduced the amount of money held by the public. Yet, many advisors continue to suffer from the "spinning your wheels" syndrome, feeling as if their efforts keep dredging up the same results—poor quality prospects or prospects who have neither the incentive nor financial capacity to take action. He says one of his best skills is his ability to always come up with ideas and hopes to sharpen that skill as his career progresses. Information and documentation can be found in our developer resources. If your ideal client is an executive or professional, LinkedIn and Twitter are generally best. Financial Education for Everyone. Subscribe to: Changes in Title 12 :: Chapter III. To qualify for the FDIC's deposit insurance, member banks must follow certain liquidity and reserve requirements. Step 1: Please select your CARD DESIGN. Effective July 22, 2010, the increased FDIC limit of $250,000 per depositor per bank is permanent. Another reason for not wanting to prospect or ineffectively prospecting can be manual prospecting.

About the Author

Having a professional website that cohesively tells your story and how you can help prospects is one place to start. All deposits held at the same FDIC insured bank in the same ownership capacity as described in the previous section are added together to determine your total amount of FDIC insurance coverage at that bank. Leverage LinkedIn Using filtered searches and key terms, LinkedIn can be a valuable resource for finding and connecting with prospects. If you're a financial advisor who's serious about generating new leads, take action today with these effective prospecting tips. Would love to know your thoughts. A: The Federal Deposit Insurance Corporation FDIC is a federal agency organized in 1933 that insures depositors' account up to the insured amount at most commercial banks and savings associations. Gov websites use HTTPS A lock LockA locked padlock or https:// means you've safely connected to the. The Pitchfork Card serves as your official ASU photo ID card, as well as your MidFirst Bank debit card. Official website of the OCC. The FDIC insures $250,000 of deposits for each individual's accounts at over 5,000 banks. July 30, 2019 • John Diehl. Cold calls are hit or miss, and direct marketing is often chucked with the junk mail. Our online account enrollment application is secure and safe. The FDIC has no authority to charter a bank, and may only close a bank if the bank's charterer fails to act in an emergency. Or maybe I'll start calling some friends I know to ask for referrals or maybe I could engage a few of Uncle Jack's sons. Sign On to Mobile Banking. Are not deposits or obligations of the Program Banks, are subject to investment risk, are not FDIC insured, may lose value, and are not Program Bank guaranteed. They go on LinkedIn because it's a vast network of professionals looking to grow their business or otherwise advance in their careers. So, for example, if you have three deposit accounts at one bank and each is worth $100,000, FDIC insurance would cover only $250,000, not the full $300,000. "If you're not growing, you're dying, especially if the advisor has an aging book. After a person looks at services or products, and he/she shows interest, that person is now a prospect. Sign In usingAssociated Mobile Banking®. According to the research published by Cerulli Associates, nearly two thirds 64% of RIAs use or have used niche marketing, and 37% consider it to be extremely effective with another 57% who have found it to be somewhat effective. On the contrary, the 1% top financial advisors, do prospecting every day.

Similar templates:

For example, if the objective is to find executive level clients, the search terms might include "executive," "president," or "chief. Distinguishes between what is and is not protected by FDIC insurance. "Companies undermine competition, erode confidence in the deposit insurance system, and threaten our hard earned savings when they engage in false marketing or advertising. Often, it will try to merge the failing bank with a stronger bank, in what is called the purchase and assumption method aka deposit assumption method, where it finds a buyer for the bank. The city name must be spelled correctly. Specifically, define whom you want to serve and who needs your services. Please consult with your tax, legal, and accounting advisors regarding your individual situation. Spend, save and grow your money with Virtual Wallet®. Try these 7 financial advisor prospecting ideas now. The $250,000 limit is permanent for certain retirement accounts including IRAs, but is scheduled to return to the former $100,000 limit for all other deposit accounts after December 31, 2013, unless the government enacts new legislation in the meantime. Think of it as an investment that can allow you to earn money in the future. It will be our pleasure to assist you. They stay consistent and do not rely on vague ads, referrals, and other old methods of prospecting to get clients. Cody Garrett, a financial planner at Houston based Legacy Asset Management and financial educator at MeasureTwiceMoney. This is a sentiment Garrett shares. 7% and for FY 2006 was 0. Since the FDIC was established in 1933, no depositor has lost a penny of FDIC insured funds. An expert on behavior change and why products and ideas catch on, he has consulted to firms and organizations including Apple to improve its customer service, Facebook to introduce new hardware products, the Gates Foundation to sharpen its messaging, Google to roll out new projects and Vanguard on marketing strategies and new products. Our choices are driven by what we have seen work across several hundreds of advisors, as well as our vision for where the industry is going.

Enhanced Content Go to Date

The FDIC is backed by the full faith and credit of the United States government. Ownership of an account has legal consequences and you may wish to consult with your attorney, tax advisor or the FDIC to determine whether you should change the ownership of an account. The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. It seems like there are no "new" financial advisor prospecting ideas any more. Currently, the FDIC insures deposits at FDIC insured banks and savings associations up to $250,000 per depositor, per FDIC insured bank, for each account ownership category. In this must read if youre a financial advisor book, you will learn how to. Effective July 22, 2010, the increased FDIC limit of $250,000 per depositor per bank is permanent. Continue to Online Banking using the full site. FDIC insurance does not cover products such as mutual funds, annuities, life insurance policies, stocks, or bonds. We use cookies to ensure we give you the best possible browsing experience. Please review the Credit Card Application Disclosure for more details on each type of card. Finding new clients becomes easy and fun when you know your target market AKA your idea, profitable client. Mid Level Officials/ Managers. That's a good start, but rarely sufficient to sustain a business. Please dive in for the 5 financial advisor prospecting ideas that we will be using in 2020. The results of this work are published as books, our quarterly journal, The Independent Review, and other publications and form the basis for numerous conference and media programs. Check out tips and information about how you can protect your personal information online. Open bank assistance is sometimes provided to keep banks open in communities that the FDIC deems was providing essential services to the community. This bill has the status Became Law. " So please subscribe. Financial Education for Everyone. Relevant insurance coverage, if applicable, will be required on collateral.

Enhanced Content Go to Date

Get started by signing in to your Pearson VUE account. This web site is designed for the current versions of Microsoft Edge, Google Chrome, Mozilla Firefox, or Safari. Please refer to the Understanding Deposit Insurance section of. By clicking on this link you are leaving our website and entering a third party website over which we have no control. If your "business is not growing then it could be dying". Textual Records: Lists of banks by amount of deposits, 1920 58. Acting as a deposit broker, can place deposits at FDIC insured banks on your behalf. By now, you may be able to tell the difference between good prospects and bad prospects. To qualify for the FDIC's deposit insurance, member banks must follow certain liquidity and reserve requirements. Get our mobile banking app. Read our SIPC information to see how we protect your Schwab brokerage account. DO NOT check this box if you are using a public computer. To find out more, please view our cookies policy. It should summarize what you do, who you do it for, and what your key differentiator is. The FDIC manages the receivership of failed banks and reimburses itself by selling the bank's assets and collecting on its loans. Help educate them on your services and advisory firm while also connecting with them by being more than just a business. Or any of its affiliates; and, may be subject to investment risk, including possible loss of value. A lot goes into prospecting for new clients, advisors have to promote themselves and their services which can be a bit overwhelming at times.